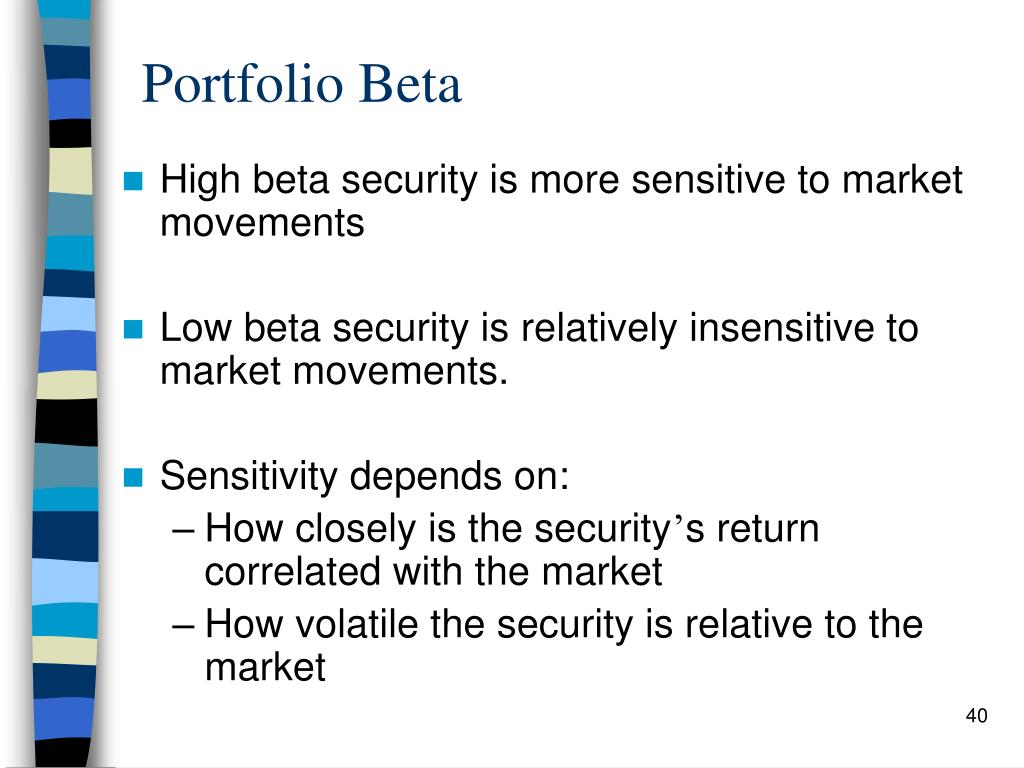

Portfolio Beta Definition . Here's how to calculate beta and what it means. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. beta is the volatility of a security or portfolio against its benchmark. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. what is portfolio beta? portfolio beta is a measure of the overall systematic risk of a portfolio of investments. in portfolio management, beta is used to construct a portfolio that matches the investor’s risk tolerance. By combining securities with different. the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). It's a numerical value that signifies how.

from www.slideserve.com

in portfolio management, beta is used to construct a portfolio that matches the investor’s risk tolerance. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. what is portfolio beta? It's a numerical value that signifies how. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. beta is the volatility of a security or portfolio against its benchmark. By combining securities with different. portfolio beta is a measure of the overall systematic risk of a portfolio of investments. Here's how to calculate beta and what it means. the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃).

PPT Portfolio Theory Capital Market Theory Capital Asset Pricing

Portfolio Beta Definition the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). It's a numerical value that signifies how. Here's how to calculate beta and what it means. what is portfolio beta? beta is the volatility of a security or portfolio against its benchmark. in portfolio management, beta is used to construct a portfolio that matches the investor’s risk tolerance. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). By combining securities with different. portfolio beta is a measure of the overall systematic risk of a portfolio of investments. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular.

From quantrl.com

The Beta of the Market Portfolio Is Quant RL Portfolio Beta Definition Here's how to calculate beta and what it means. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. what is portfolio beta? in portfolio management,. Portfolio Beta Definition.

From www.slideserve.com

PPT Portfolio Theory Capital Market Theory Capital Asset Pricing Portfolio Beta Definition portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. . Portfolio Beta Definition.

From optionalpha.com

What is Portfolio Beta Option Alpha Portfolio Beta Definition Here's how to calculate beta and what it means. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. By combining securities with different. beta is the. Portfolio Beta Definition.

From wealthface.com

What is portfolio beta and How to calculate beta of a portfolio? Wealthface Portfolio Beta Definition the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). beta is the volatility of a security or portfolio against its benchmark. what is portfolio beta? By combining securities with different. in portfolio management, beta is used to construct a portfolio that matches the investor’s risk tolerance. Portfolio beta is. Portfolio Beta Definition.

From www.thestockdork.com

Portfolio Beta vs Standard Deviation Understanding Risk Measures in Portfolio Beta Definition in portfolio management, beta is used to construct a portfolio that matches the investor’s risk tolerance. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. beta is the volatility of a security or portfolio against its benchmark. the determining basis used by investors. Portfolio Beta Definition.

From quizquadratrix.z21.web.core.windows.net

What Is The Portfolio Beta Portfolio Beta Definition what is portfolio beta? Here's how to calculate beta and what it means. By combining securities with different. It's a numerical value that signifies how. the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a.. Portfolio Beta Definition.

From www.slideshare.net

Portfolio beta Portfolio Beta Definition the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. portfolio beta is a measure of. Portfolio Beta Definition.

From www.youtube.com

How to calculate the Portfolio Beta ( fast and easy ) ) YouTube Portfolio Beta Definition portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. It's a numerical value that signifies how. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. Here's how to calculate beta and what it means. By combining securities with different. the determining. Portfolio Beta Definition.

From www.youtube.com

How to Calculate Beta Portfolio Beta Example and Interpretation Portfolio Beta Definition Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. beta is the volatility of a security or portfolio against its benchmark. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. in portfolio management, beta is used. Portfolio Beta Definition.

From www.slideserve.com

PPT CAPM and the Characteristic Line PowerPoint Presentation, free Portfolio Beta Definition It's a numerical value that signifies how. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. beta is the volatility of a security or portfolio against its benchmark. what is portfolio beta? portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a. Portfolio Beta Definition.

From getmoneyrich.com

Alpha and Beta of Investment Portfolio What is its utility? GETMONEYRICH Portfolio Beta Definition portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. It's a numerical value that signifies how. in portfolio management, beta is used to construct a portfolio that matches the investor’s risk tolerance.. Portfolio Beta Definition.

From hedgefundalpha.com

How To Calculate The Beta Of A Portfolio Hedge Fund Alpha (formerly Portfolio Beta Definition beta is the volatility of a security or portfolio against its benchmark. what is portfolio beta? Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. By combining securities with different. It's a numerical value that signifies how. portfolio beta is a measure of the overall systematic risk of a. Portfolio Beta Definition.

From finance.yahoo.com

Portfolio Beta vs. Stock Beta What's the Difference? Portfolio Beta Definition portfolio beta is a measure of the overall systematic risk of a portfolio of investments. Here's how to calculate beta and what it means. what is portfolio beta? the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. in portfolio management, beta is used. Portfolio Beta Definition.

From marketxls.com

Portfolio Beta Calculator MarketXLS Portfolio Beta Definition beta is the volatility of a security or portfolio against its benchmark. portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. what is portfolio beta? the beta is the number. Portfolio Beta Definition.

From www.slideserve.com

PPT Return, Risk, and the Security Market Line PowerPoint Portfolio Beta Definition By combining securities with different. Here's how to calculate beta and what it means. what is portfolio beta? the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. It's. Portfolio Beta Definition.

From www.slideserve.com

PPT Portfolio Theory Capital Market Theory Capital Asset Pricing Portfolio Beta Definition portfolio beta is a metric (or indicator) that investors use to measure the volatility associated with a particular. portfolio beta is a measure of the overall systematic risk of a portfolio of investments. Here's how to calculate beta and what it means. It's a numerical value that signifies how. the determining basis used by investors to gauge. Portfolio Beta Definition.

From www.slideshare.net

The beta of the market portfolio Portfolio Beta Definition portfolio beta is a measure of the overall systematic risk of a portfolio of investments. the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). what is portfolio beta? Portfolio beta is a measure of the systematic risk of a portfolio of securities relative to a. By combining securities with different.. Portfolio Beta Definition.

From gofreedommoney.com

Zero Beta PortfolioDefinition & Beispiel 2024 Finanzwörterbuch Portfolio Beta Definition the determining basis used by investors to gauge an investment’s risk and sensitivity is beta (𝛃). Here's how to calculate beta and what it means. the beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in. beta is the volatility of a security or portfolio against. Portfolio Beta Definition.